Using the account setup seen previously, let's go through an example. Assume that there are 2 employees (E1 and E2) which each earn $1000 per month gross salary. The employee contribution to Tax1 and Tax2 are 10% and 5% respectively. The company contribution to Tax1 and Tax2 are 15% and 10% each on top of the employees gross salary.

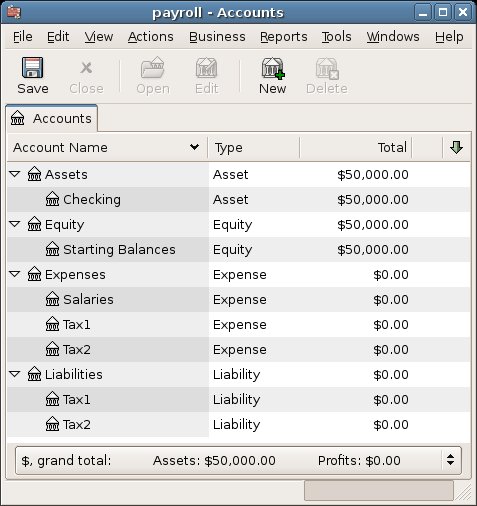

Staring with $50k in the bank, and before doing any payroll, the account hierarchy looks like this:

Payroll Initial Setup

The deductions list for employee 1:

E_GROSS_SALARY - Employee gross salary - $1000

E_TAX1 - Employee contribution to tax1 - $100 (10% of E_GROSS_SALARY)

E_TAX2 - Employee contribution to tax2 - $50 (5% of E_GROSS_SALARY)

C_TAX1 - Company contribution to tax1 - $150 (15% of E_GROSS_SALARY)

C_TAX2 - Company contribution to tax2 - $100 (10% of E_GROSS_SALARY)

表 14.2. Transaction Map for Employee 1

| Account | Increase | Decrease |

|---|---|---|

| Assets:Checking | $850 (E_NET_SALARY) | |

| Expenses:Salaries | $1000 (E_GROSS_SALARY) | |

| Liabilities:Tax1 | $100 (E_TAX1) | |

| Liabilities:Tax2 | $50 (E_TAX2) | |

| Expenses:Tax1 | $150 (C_TAX1) | |

| Liabilities:Tax1 | $150 (C_TAX1) | |

| Expenses:Tax2 | $100 (C_TAX2) | |

| Liabilities:Tax2 | $100 (C_TAX2) |

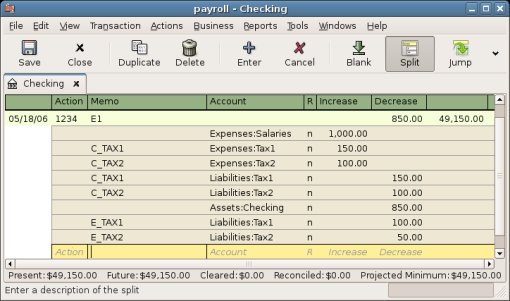

Now, enter the first split transaction for employee 1 in the checking account. The split transaction looks like this:

Employee 1 Split Transaction

| ティップ |

|---|---|

When paying employees, enter only the employee name in the Description area. If you decide to use GnuCash's check printing capabilities, the check is automatically made out to the correct employee. If you want to record other information in the transaction besides the employee name, use the Notes area, available when viewing the Register in double-line mode. | |

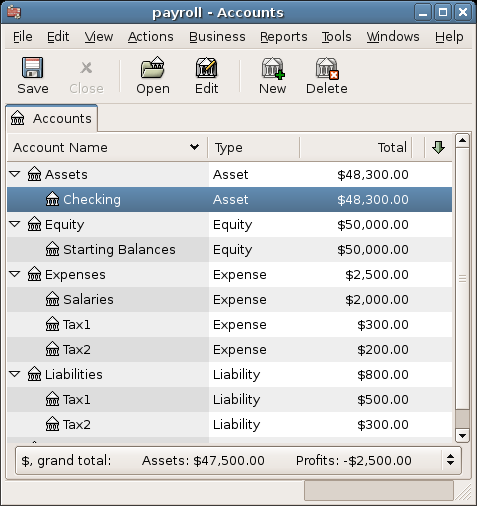

Repeat this for the second employee, which leaves the account hierarchy looking like this:

Account Tree After Salaries Paid

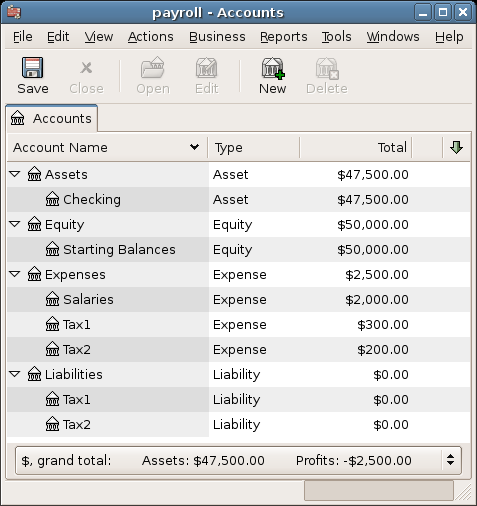

The Liabilities:Tax1 and Liabilities:Tax2 accounts continue to track how much you must pay to the government agencies responsible for each. When it is time to pay these agencies, make a transaction from the checking account to the liability accounts. No expense accounts are involved. The main account will then appear like this for this example:

Accounts After Paying Government