It is not always you are borrowing money from the bank, sometimes you borrow money from your family, or perhaps even lend money to a friend. This How-To chapter will describe one way to handle lending money to a friend.

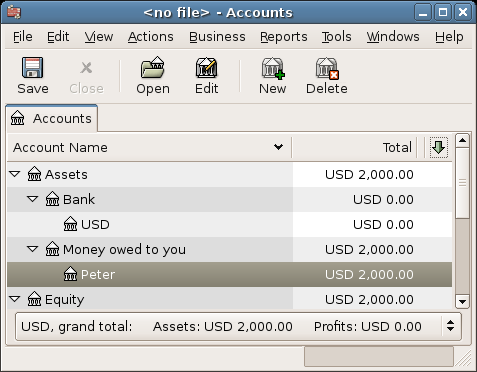

We are basing this How-To on the following generic account structure.

-Asset

-Bank

-Bank Account

-Money owed to you

-Person

-Income

-Interest Income

-Person

This example will show how to track a personal loan of 2,000 USD (default currency) to your friend Peter

Peter wants to borrow $2,000 dollars from you and plans to pay you back montly for the next 18 months. Since he is your friend, (but not that close) you both agree on a yearly interest rate of 5%

In summary we have the below details. Peter's loan details:

Pinciple Amount - $2,000

Term - 18 months with 12 payments per year

Annual Percentage Rate: 5%

Monthly Payment : ??

So how do you caculate the Montly Payment?

You have a number of different options, like paper and pen, Linux Calculator, Open Office's Calc module, but the easiest is to use GnuCash Financial Calculater. This gives you that the Monthly Payment should be 115.56$.

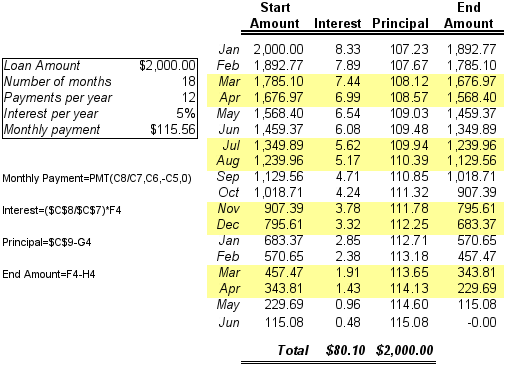

But you need to know how much of this is Interest and how much is Principal to be able to do a proper bookkeeping. For this you need a more powerful tool, something like the Calc module in Open Office, and in particular the PMT function.

Detailed view over the private loan to Peter

Lets start with the following acccounts (all accounts have the same currency, in this case USD)

Assets:Bank:USD

Assets:Money owed to you:Peter

Income:Interest Income:Peter

Equity:Opening Balances:USD

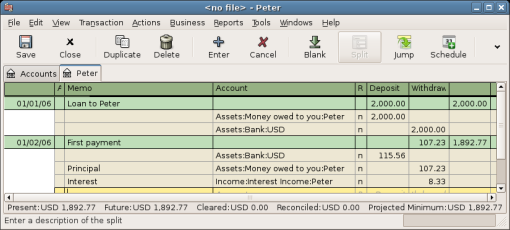

When you have lended money to your friend, you have in fact moved money from an Asset account (like Bank, Checking or similar) to your Asset account "Money owed to you". To record this you enter the following transaction into the Assets:Money owed to you:Friend account.

表 7.2. Personal loan to a Friend

| Account | Increase | Decrease |

| Assets:Money owed to you:Friend | $2,000 | |

| Assets:Bank:USD | $2,000 |

Chart of Accounts after lending money

When the first payment ($115.56) is received, you will need to determine how much is for the principal loan, and how much is for the loan interest.

Outstanding loan amount this period = $2,000

Payment per month = $115.56

Payment breakdown

5%/12 * $2,000 = $8.33 Interest

$115.56 - $8.33 = $107.23 Principle

This can be translated to the following GnuCash entry

Detailed view over first payment

The balance on Peters loan is now $2,000 - $107.23 = $1,892.77

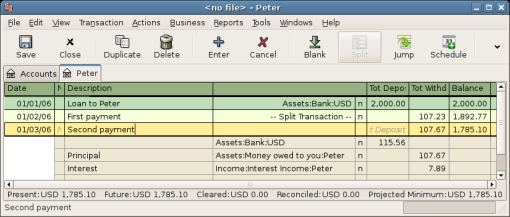

When the second payment ($115.56) is received, you will again need to determine how much is for the principal loan, and how much is for the loan interest.

Outstanding loan amount this period = $1,892.77

Payment per month = $115.56

Payment breakdown

5%/12 * $1,892.77 = $7.89 Interest

$115.56 - $7.89 = $107.67 Principle

This can be translated to the following GnuCash entry

Detailed view over the second payment

The balance on Peters loan is now $1,892.77 - $107.67 = $1,785.10

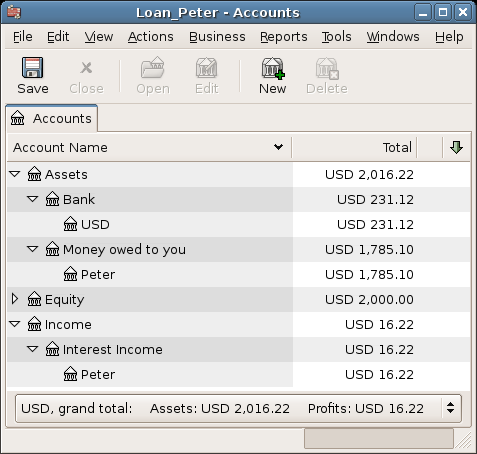

The Chart of accounts looks now like this

Chart of Accounts after second payment

As you can see, the interest varies for every month, as well as the principal amount. So for every payment you receive you need to calculate the proper amounts for your various split entries.

The interest amount will be less and less for every payment (since it is calculated on a smaller loan amount all the time), until the last payment where it is more or less 0. Please review the Figure of Detailed view over private loan to Peter for more details