Transactions are typically checked against bank statements - a process known as "reconciliation". GnuCash keeps track of the reconciliation status of each transaction.

The reconciliation status of a transaction is shown by the reconciliation (R) field. 'y' indicates that a transaction has been reconciled, 'n' indicates that it has not, and 'c' indicates that it has been cleared, but not reconciled. You can toggle the reconciliation status between 'n' and 'c' by clicking in the (R) field; you can set it to 'y' by using the Reconciliation Window.

At the bottom of the account window, there are two running totals: 'Balance', and 'Cleared'. 'Cleared' should correspond to how much money the bank thinks you have in your account, while 'Balance' includes outstanding transactions.

The Reconciliation Window is used to reconcile a GnuCash account with a statement that a bank or other institution has sent you. Reconciliation is useful not only to double-check your records against those of your bank, but also to get a better idea of outstanding transactions, e.g. uncashed checks.

At the bottom of the account window, there are two running balances: the "cleared and reconciled" balance, and the "total" balance. The "cleared and reconciled" balance should correspond to how much money the bank thinks you have in your account, and the "total" balance includes outstanding transactions.

For example, when you write a check for something, you should enter the transaction into GnuCash. The reconciliation (R) field of the transaction will initially contain n (new). Your new entry will contribute to the "total" balance, but not to the "cleared and reconciled" balance. Later, if you think that the check has been cashed, you might click on the transaction's R field to change it to c (cleared). When you do this, the "cleared and reconciled" balance will change to include this amount. When the bank statement arrives, you can then compare it to what you've recorded in GnuCash in the Reconciliation window. There, you will be able to change the R field to y (reconciled). You cannot reconcile in the register window, you must use the reconciliation window. Once a transaction has been marked "reconciled", it can no longer be easily changed.

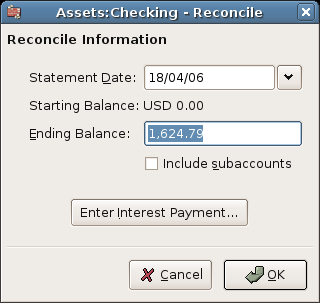

To use the Reconciliation Windows, select an account from the account tree and click on Actions -> Reconcile. A window will appear in which you can enter the reconcile information.

The initial reconcile window.

Reconcile Info: Statement Date - this is the date of the statement you will be reconciling against.

Reconcile Info: Starting Balance - this is a non-editable item which displays the balance from the previous reconciliation. It should match the starting balance in your statement.

Reconcile Info: Ending Balance - this is the ending balance as it appears in the statement.

Reconcile Info: Include Sub-accounts - select this if you want to include the sub-accounts of the currently selected account in this reconciliation.

Enter Interest Payment - click here to enter an interest transaction to the account to be reconciled.

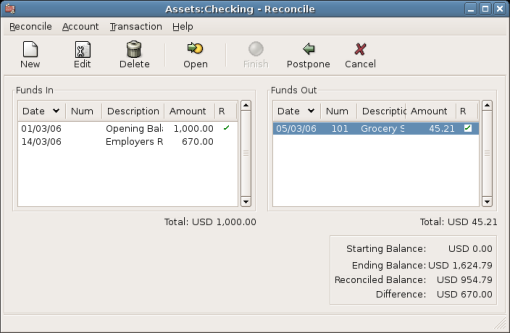

Click on the Ok button, and you will see the transactions listing reconcile window:

The transactions listing in the reconcile window.

The two lists called Funds In and Funds Out lists all the unreconciled transactions. The 'R' columns show whether the transactions have been cleared or reconciled.

Now, examine each item on the bank statement, and look for the matching item in the Reconcile window.

If you cannot find one, then perhaps you forgot to enter a transaction, or did not know that the transaction had happened. You can use the New button on the tool bar, or the New menu item in the Transaction menu, to open a register window and enter the missing transaction. The new item will appear in the Reconcile window when you press enter after entering the transaction.

When you find the item in the Reconcile window, compare the amount in the item to the amount on the statement. If they disagree, you may have made an error when you entered the transaction in GnuCash. You can use the Edit button on the tool bar, or the Edit menu item in the Transaction menu, to open a register window and correct the transaction.

If the amounts agree, click on the item in the Reconcile window. The 'R' column will change to 'y' (reconciled) from 'n' or 'c'. You may also use the up/down arrow keys to scroll to the item and then press the space key. This will also change the 'R' column to show the item as reconciled.

You then repeat this for each item that appears on the bank statement, verifying that the amounts match with the amounts in GnuCash, and marking off transactions in GnuCash as they are reconciled.

At the bottom of the "Reconcile" window is a "Difference" field, which should show $0.00 when you are done reconciling. If it shows some other value, then either you have missed transactions, or some amounts may be incorrect in GnuCash. (Or, less likely, the bank may have made an error.)

When you have marked off all the items on the bank statement, and when the difference is $0.00, press the Finish button on the tool bar or select Finish from the Reconcile menu. The Reconcile window will close. In the Register window, the R field of the reconciled transactions will change to 'y'.

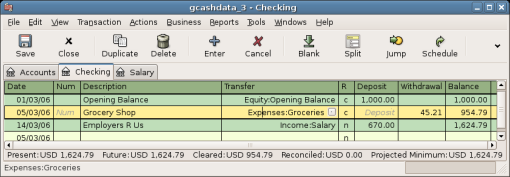

In this case, we have not received all the information yet, so we simply press the Postpone, so we can continue at a later stage. Observe that the 'R' column indicates we cleared ('c') two transactions. They have not been reconciled yet, but we have verified these two transactions so they have been marked as cleared. If you look at the status bar at the bottom of the account register, you will see a summary of what has been reconciled and what has been cleared (Cleared:USD 954.79 Reconciled:USD 0.00)

The Checking account after postponed the reconciliation.